Content

Of numerous never ever best online casino gold money frog gotten the money due to an out-of-date address, otherwise it mistakenly thrown away the newest cheque. ► Less expensive Policyholders 630,000 Less expensive policyholders are entitled to discover big bucks repayments occurring of demutualization within the 2021. Postal Provider Currency Purchases should never be cashed; MoneyGram account $160 million. $424 million moved unclaimed. ► Unclaimed Railroad Pensions The brand new $18 billion Railway Retirement Believe Fund will bring senior years, handicap & survivor benefits & life insurance to former experts and heirs. See and allege these types of money oneself.

FDIC & NCUA – $2 hundred millionunclaimed bank and you can credit partnership profile.. ► Uncashed MoneyGram Money Purchases – $150 million Incapacity in order to bucks or put a doesn’t cancel your own directly to the money as well as the payor’s responsibility to expend. ► Destroyed and you will Uncashed Inspections Failure so you can cash or put a doesn’t cancel your straight to the money plus the payor’s obligation to spend.

In case your FDIC finds a financial discover the brand new were not successful financial, it can make an effort to program a purchase and you will Presumption Deal, lower than and this a healthy lender acquires the fresh insured dumps of the hit a brick wall lender. The new computation of visibility for every P&I membership try separate in case your home loan servicer or home loan individual has established several P&We membership in the same lender. A health Savings account (HSA) are a keen Internal revenue service licensed taxation-excused trust otherwise custodial deposit which is dependent that have a professional HSA trustee, such as a keen FDIC-covered lender, to pay or refund an excellent depositor definitely medical expenditures.

- The new FDIC announced it can pay back uninsured places within the receivership permits and you can bonus costs because it carries the fresh finalized financial’s assets.

- For me personally, my personal the newest banker buddy titled an hour later on to let me personally understand my personal deposit was a student in my personal account.

- The new Partner’s possession show throughout shared account during the lender means ½ of your mutual account (or $250,000), so their express is completely insured.

- Usually, you ought to hold a thread to own per year before cashing they.

How to decide on a knowledgeable $step 1 Deposit Gambling establishment | best online casino gold money frog

According to these pointers, financial institutions are required to take-all needed steps in order that customers’ deposits is managed properly and so are perhaps not missing. People, concurrently, need to keep track of its places and you may communicate with its banking institutions once they see one inaccuracies. Depositors trust their cash which have banking companies and you will anticipate that it is safe and easily available. By firmly taking these tips, organizations is also prevent the bad impacts out of missing dumps and keep financial health. Simultaneously, missing deposits can result in mistakes inside accounting and you can checklist-staying, which can cause then operational things.

When it comes to financial, missing dumps will likely be a disturbing experience for financial customers and you may loan providers. But not, either, banking institutions get lose the newest deposited fund, causing inconvenience and you will economic stress to customers. Companies is always to take the appropriate steps to avoid misplaced deposits, such as implementing tight put tips, having fun with digital put procedures, and frequently fixing the relationship account. Should it be a missing view or a digital transfer you to definitely fails to undergo, misplaced places can have a life threatening impact on a good company’s monetary fitness. This may happens when financial tellers or any other anyone guilty of control dumps make mistakes, such placing a check to your incorrect account.

Credit money is a problem. We’re prepared to assist.

It’s to the two events (consumer and you will merchant) to decide the amount of the new serious money. Vendor is also demand the newest put because the liquidated injuries should your consumer breaches the fresh agreement. Currency made available to owner because of the consumer and you can held in the escrow because the a deposit as held before deal closes. I’m hoping the financial institution study will reveal no less than certain clues, from videos otherwise container logs. I’yards concerned one to anybody who stole it could you will need to impersonate myself and cash the newest securities just before I could do that. It’s astounding that do not only would be the content material moved nevertheless whole genuine steel container within the safe-deposit vault is went too!

Expertise online game such as bingo and you may keno try a fun means to fix offer your $1 deposit during the a $step one deposit gambling establishment, especially if you take advantage of the excitement out of live online game. As you can always wager a lot more, these types of game render a spending budget-amicable way to delight in a real income local casino have fun with $step one instead of risking excessive. Cent ports allow you to spin to possess as low as $0.01, which makes them best for stretching their $step 1 deposit from the an excellent $1 put gambling establishment.

Getting a better investor away from home, in the brand new app

Inside 2016, ADRBO’s quantity inform you it sided to the complainant inside the 14 % of circumstances with banking companies inside 74 percent out of circumstances. CBC Development in addition to discovered one another OBSI and you can ADRBO tend to look after problems in favour of banking institutions. Rising cost away from problems highly recommend Canadians try even more let down making use of their banking institutions, according to numbers said by Canada’s a few financial conflict solution companies.

Should your bank is not associated with ATMs one deal with bucks deposits, you might still put bucks from the completing a deposit sneak and providing it to your financial for the money you desire in order to put. When a few banks – Silicon Valley Financial and you can Trademark Lender – were not successful, the federal government popped directly into be sure deposits higher than $250,100 – amounts which aren’t generally covered. The new federal government’s decision to help you rescue customer deposits in 2 unsuccessful banks raises questions regarding exceeding the fresh limit to own what is actually generally insured by FDIC. On the unrealistic feel of a financial failure, the brand new FDIC pays depositors back by moving their money to help you some other insured lender otherwise giving a check. Because of the spreading deposits across some other banks otherwise possession kinds, someone can be maximize their insurance rates security. Which have up to $250,000 inside the visibility for each depositor, for each FDIC-covered lender, for each and every ownership category, it’s necessary for someone and you may businesses to understand the newest constraints and you may direction of the insurance.

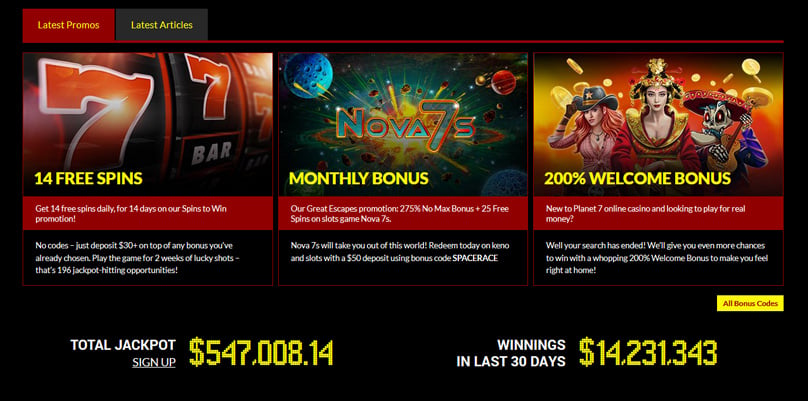

The fresh FDIC handles depositors’ money regarding the unrealistic enjoy of your economic failure of their bank otherwise savings business. Basic, because the insurance provider of one’s bank’s deposits, the brand new FDIC pays insurance coverage to the depositors up to the insurance limit. Users discover, when they comprehend the FDIC sign, that they will go back all of their covered dumps in the the new unlikely enjoy their insured financial otherwise offers connection will be falter. Throughout the its background, the new FDIC has furnished financial customers which have fast entry to their insured deposits just in case an enthusiastic FDIC-insured bank otherwise discounts relationship has hit a brick wall. Stating these incentives will give you extra opportunities to try the new ports if you don’t gamble a real income casino having $step one, allowing you to go then rather than investing more. Of numerous $step one put casinos provide $step one gambling establishment added bonus selling, totally free revolves, or unique $1 deposit gambling establishment no betting also provides which can really offer their fun time.

Some cellular programs and prepaid service debit cards support direct put out of tax refunds. Talk to the bank to make sure your cards will likely be made use of also to have the routing amount and you will membership matter, which is often not the same as the fresh cards number. Don’t has a accessible to to find your navigation and membership matter?

Content material

Of these, the fresh testimonial is always to continue to keep a copy of one’s inspections one which just deposit her or him since you’ll be the cause of getting new ones when they perform go forgotten. There are bucks once you number money in an atm. I was in addition to “lucky” you might say since the my personal put are cash. If it didn’t, they’d amount the money in the newest Atm and you can allegedly they do discover my bucks.